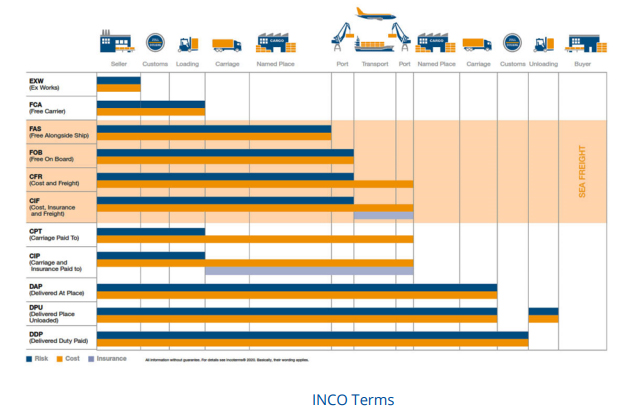

What is INCOTERMS?

“Incoterms” is a registered trademark of the International Chamber of Commerce (ICC). Incoterms are a set of rules which define the responsibilities of sellers and buyers for the delivery of goods under sales contracts. They are published by the ICC and are widely used in commercial transactions. Globally recognized, Incoterms prevent confusion in foreign trade contracts by clarifying the obligations of buyers and sellers. Incoterms inform sales contracts defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer, but they do not themselves conclude a contract, determine the price payable, currency or credit terms, govern contract law or define where title to goods transfers.

Advantages of Incoterms

● One of the primary benefits is the simplification of contractual terms. When Incoterms exist, they are often used in commercial contracts, ensuring a single form of interpretation of the terms, saving time and money that was previously often wasted by misinterpretations of the contractual terms. In this way, the Incoterms have been an important tool for the development of international trade.

● The use of the commercial terms helps to eliminate any kind of inconsistency and ambiguity related to shipping contracts and sales which are country-specific.

● The buyers and sellers can easily manage and identify the liabilities and risks of transporting cargo from the source to the delivery destinations.

● The Inco terms allow buyers and carriers to understand who owns the goods at each stage of the shipment, as well as who pays the shipping costs.

● The ownership transfer point (the point from which you no longer own the goods)

● The company responsible for the choice of the carrier, or transporter

Why INCOTERMS?

The use of Incoterms eliminates inconsistencies in language by giving all parties the same definition of specific terms within a trade agreement. As a result, the risk of problems during shipment is reduced since all parties clearly understand their responsibilities in performing trade under the given contract. The Incoterms rules are an internationally acknowledged standard and are used all over the world when it comes to international and national contracts for the sale of goods

We follow the guidelines of the Customs Act and discharge our obligations as a Custom Broker with the highest standards of professionalism and ethics. Our goal is to provide seamless and efficient customs clearance services, helping our clients to avoid delays and ensuring compliance with all regulations.

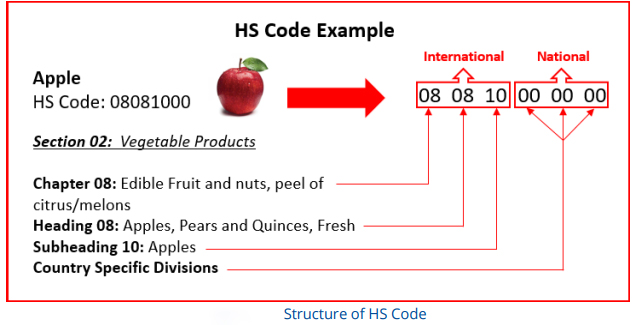

What is HS Code?

The Harmonized Commodity Description and Coding System, also known as the Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products. It came into effect in 1988 and has since been developed and maintained by the World Customs Organization (WCO) (formerly the Customs Co-operation Council), an independent intergovernmental organization based in Brussels,Belgium, with over 200 member countries.

When are HS Codes required?

The Harmonized system (HS) classification is a six-digit code for classifying internationally traded goods. These codes are used by customs authorities across the world to identify tax and duty rates for different products. Introduction HS codes are administered by the World Customs Organization and are recognized in over 98 percent of the global trade. This code is a universal classification tool. Many countries add additional digits to this code to further classify the products in specific categories. These digits differ across countries.

These codes are required for international export documentation and all commercial invoices. In fact, any documents that are used internationally should display the HS code.

What’s the structure of HS Code?

There are ten digit numbers of a full code. To ensure harmonization, the contracting parties must employ at least 4-digit and 6-digit provisions, international rules and notes, but are free to adopt additional subcategories and notes.